Accounting for Convertible Bond

Accounting for Convertible Bonds Debt. The bonds get secured with the companys physical assets and the bonds get converted only at the discretion of the bondholder.

Convertible Bonds Using Book Value Method Accounting Complete Calculations J E S Youtube

2 Full PDFs related to this paper.

/ConvertibleBondsPrice2-2285ff1211c545be919565380a232a02.png)

. Besides that the knowledge about common terminologies of accounting help to easily understand the accounting in detail. First the current market price of the bond can be readily observed in which the bond can either trade at a discount at par or a premium to par. Read more Interest Rate 100 Debt Amount.

What is a Convertible Bond. Corporations and governments may use both a debenture and a bond to raise capital. Dictionary of Accounting Termspdf.

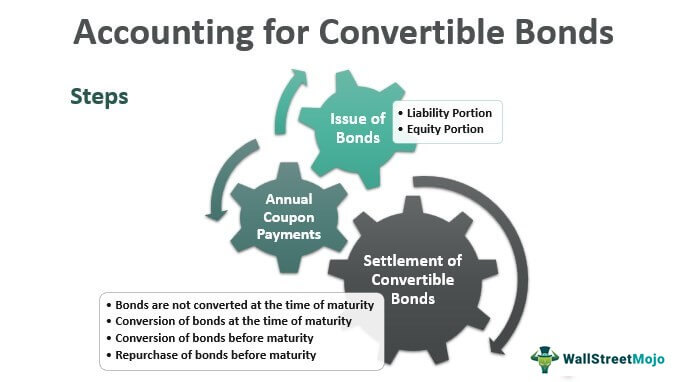

In calculating the amount of bond premium the. The interest accrues to the principal invested thus increasing the issued number of shares during the. Accounting for Convertibles refers to the accounting of the debt instrument that entitles or provides rights to the holder to convert its holding into a specified number of issuing companys shares where the difference between the fair value of total securities along with other consideration that is transferred and the fair value of.

Specifically there would be no interest expense adjustment to the. To induce holders of the bonds to convert them into company stock Armadillo offers to reduce the conversion price to 10 if the. A short summary of this paper.

Typically convertible notes accrue an interest rate. We illustrate the journal entry for the retirement at maturity before maturity as well as by conversion. Convertible bonds are fixed income long term financial instruments that a company can transform into equity shares after a specified period of time.

Next the annual coupon must be calculated which is a function of the bonds coupon rate par value and payment frequency if applicable ie. We can also call it a junior debt subordinated. Subordinated debt is a debt that ranks lower than most other types of debt and securities in terms of claim on the borrowers assets.

A convertible bond is a type of debt security that provides an investor with a right or an obligation to exchange the bond for a predetermined number of shares in the issuing company at certain times of a bonds lifetime. People also downloaded these free PDFs. The bonds had a carrying value of 421620 and Riley paid 401937 for them.

In simple words we can say that if a borrower defaults the lender of the subordinated debt will get the payment only after the payment is made to all other debt holders. The bond is convertible into Armadillo stock at a conversion price of 20. Convertible bondholders get only a fixed limited income until conversion date irrespective of how profitable the company is which in actual is a vantage for the.

Known in practice as an Instrument C bond is included in diluted EPS using the if-converted method as described in ASC 260-10-55-84 through ASC 260-10-55-84B. It is a hybrid security that possesses features of both debt and equity. People also downloaded these PDFs.

They are also hybrid financial products that have features both of equity as well as debt. People also downloaded these free PDFs. To do so they focus on convertible bonds and convertible preferred stocks.

A company may add warrants to newly issued shares of stock or to bonds as an incentive for investors. A bond that can be converted to cash debt or equity at the discretion of the issuer at a set date. Acquired some of the outstanding bonds of one of its subsidiaries.

The accounting treatment for options with performance conditions under ASC 718 requires a probability assessment as to. Some of them are as follows. Example of Accounting for Convertible Securities.

It entitles convertible noteholders to convert to an equity stake in the company at the lower of the valuation price or valuation cap in the subsequent financing rounds. Armadillo Industries issues a 1000 face amount convertible bond that sells for 1000. The coupon rate must be annualized.

Convertible-bond portfolios are designed to offer some of the capital-appreciation potential of stock portfolios while also supplying some of the safety and yield of bond portfolios. Therefore the cost of convertible bond is at 1039. In this section we cover the bond retirement journal entry with examples.

Issued 240000 debentures at 5 coupon rate. How should you account for the difference between the carrying value and the purchase price in the consolidated financial statements for 2018. A warrant is a contract that grants you the right.

This is the first term is the glossary of the accounting. Full PDF Package Download Full PDF Package. Interest Expense Interest Expense Interest expense is the amount of interest payable on any borrowings such as loans bonds or other lines of credit and the costs associated with it are shown on the income statement as interest expense.

Cost of Convertible Bond 8 841 841 - 565 12 8 Cost of Convertible Bond 1039. However debentures are bonds that are not secured by the assets of the entity that issues them. Convertible bonds allow investors to convert the bonds into shares of stock usually at a preset price.

It is important to learn about Accounting terminologies before starting with the study of accounting. Reverse Convertible Bond - RCB. Bond Retirement Journal Entry.

The bond contains an embedded derivative that allows the issuer. Determine the interest paid. A holder that purchases convertible debt at a premium generally would be subject to the bond premium amortization rules which generally add the premium to the holders basis in the convertible debt unless an election is made to amortize it and to reduce the holders current interest inclusions by the amortized portion.

They are usually. For a detailed calculation of the convertible bond you can read another article on the convertible bond. Similar to regular bonds a.

Study with Quizlet and memorize flashcards terms like On January 1 2018 Riley Corp.

Convertible Bonds Using Book Value Method Accounting Complete Calculations J E S Youtube

Convertible Bonds Primer On Conversion Features Of Debt Securities

Convertible Bonds Using Market Value Method Accounting Complete Calculations J E S Youtube

/ConvertibleBondsPrice2-2285ff1211c545be919565380a232a02.png)

An Introduction To Convertible Bonds

Accounting For Convertible Bonds Debt With Examples

Accounting For Convertible Bonds With Incentives Residual Method Ifrs Aspe Youtube

Comments

Post a Comment